Description:

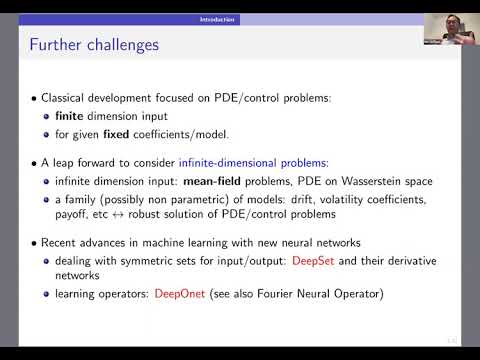

Explore cutting-edge machine learning techniques for solving symmetric problems in high-dimensional partial differential equations and control theory during this virtual talk by the Society for Industrial and Applied Mathematics. Delve into DeepSet neural networks and their derivatives, examining their applications in multi-asset option pricing, optimal trading portfolios, and mean-field control problems. Learn about particle approximations, convergence rates, and the combination of DeepSet with DeepOnet architectures for efficient approximation of optimal trading strategies. Gain insights into solving symmetric PDEs, including examples of mean-field systemic risk and mean-variance problems, while comparing the performance of DeepSet networks to classical feedforward networks.

DeepSet and Derivative Networks for Solving Symmetric Problems

Add to list

#Computer Science

#Machine Learning

#Engineering

#Control Theory

#Mathematics

#Differential Equations

#Partial Differential Equations

#Business

#Finance

#Option Pricing