Description:

Explore a reduced-form market model incorporating financial assets and life insurance liabilities under model uncertainty in this 37-minute lecture by Professor Francesca Biagini from Ludwig Maximilian University of Munich. Delve into an extension of the framework to include mortality intensities following an affine process under parameter uncertainty. Learn about the definition and computation of longevity bonds under model uncertainty, conditions for ensuring a càdlàg modification of the bond's value process, and the arbitrage-free nature of the extended market model. Examine the pricing of contingent claims and life insurance liabilities in this setting. Gain insights into the fundamental concepts of risk and uncertainty as part of a workshop commemorating the centenary of Frank Knight's "Risk, Uncertainty, and Profit" and John Maynard Keynes' "A Treatise on Probability." Discover how these influential works have shaped economic and probability theory over the past century.

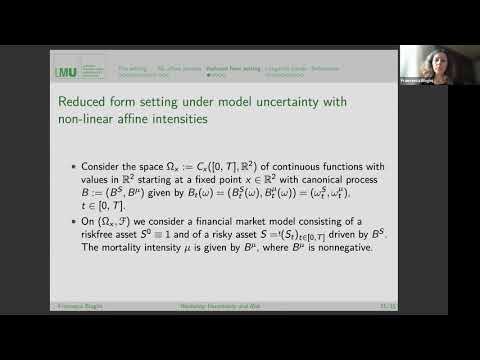

Reduced Form Setting Under Model Uncertainty With Nonlinear Affine Intensities - Prof Francesca Biagini

Add to list