Description:

Explore a comprehensive virtual talk series on mathematical finance and engineering in this one-hour presentation organized by the SIAM Activity Group on Financial Mathematics and Engineering. Delve into two key topics: a general framework for modeling roll-over risk in quantitative finance, presented by Mesias Alfeus from Stellenbosch University, and the exploration-exploitation trade-off in continuous-time episodic reinforcement learning with linear-convex models, discussed by Yufei Zhang from the London School of Economics. Gain insights into basis swaps, Liois spreads, arbitrage strategies, and roll-over risk, as well as learning algorithms, exploration policies, and performance gap assumptions in reinforcement learning. Hosted by Sam Cohen from the University of Oxford, this talk offers a deep dive into cutting-edge research in financial mathematics and engineering.

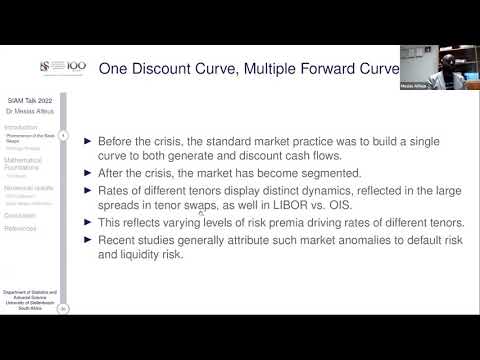

Quantitative Finance - Toward A General Framework for Modelling Roll-Over Risk

Add to list

#Conference Talks

#SIAM (Society for Industrial and Applied Mathematics)

#Engineering

#Business

#Finance

#Quantitative Finance