Description:

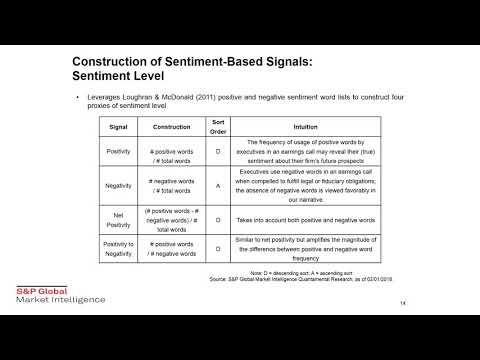

Explore natural language processing techniques for stock selection using earnings call transcripts in this 22-minute video from Open Data Science. Learn how to decipher sentiment- and behavioral-based signals that have demonstrated historical stock selection power in the U.S. market. Discover the ABCs of NLP, understand its importance in finance, and delve into the general steps of NLP analysis. Examine the process of text preprocessing, signal construction for both sentiment-based and behavioral-based indicators, and review empirical results. Gain insights into controlling for risk and alpha factors, natural tilts of sentiment-based signals, and correlation analysis. Enhance your understanding of how unstructured data can be leveraged to differentiate sources of alpha in investment strategies.

Natural Language Processing - Deciphering the Message Within the Message Stock Selection

Add to list

#Computer Science

#Artificial Intelligence

#Natural Language Processing (NLP)

#Sentiment Analysis

#Business

#Finance

#Financial Analysis

#Machine Learning

#Text Preprocessing