Description:

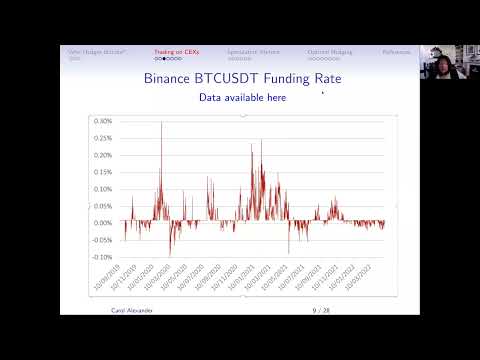

Explore hedging strategies for Bitcoin futures in this 51-minute lecture by Carol Alexander from the University of Sussex. Delve into the world of cryptocurrency derivatives trading, focusing on perpetual futures contracts and the Binance BTCUSDT funding rate. Examine clearing activities, liquidation protocols, and various speculation metrics including the Turnover Index and Liquidation Index. Learn about implied leverage, margin constraints, and parameter estimation for optimal hedge positions. Analyze empirical results and draw conclusions on effective hedging techniques for Bitcoin futures with automatic liquidation and leverage selection.

Hedging with Automatic Liquidation and Leverage Selection on Bitcoin Futures

Add to list

#Business

#Finance

#Fintech

#Cryptocurrency

#Cryptocurrency Trading

#Corporate Governance

#Risk Management