Description:

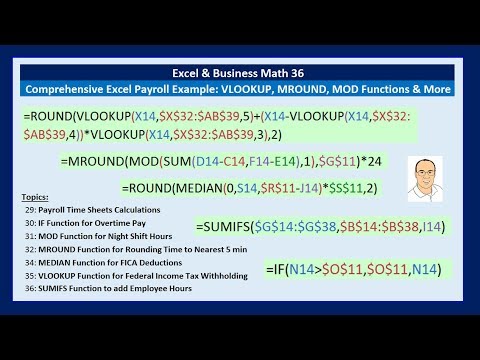

Dive into a comprehensive 29-minute video tutorial on creating a complete payroll table solution in Excel. Master essential functions like SUMIFS, MROUND, MOD, and VLOOKUP while learning to calculate hours worked, gross pay, deductions, and net pay. Follow along with downloadable start files and PDF notes as you explore formulas for regular and overtime hours, Social Security and Medicare deductions, federal income tax withholding, and more. Perfect for business math students and professionals looking to enhance their Excel skills in payroll management.

Comprehensive Excel Payroll Example - SUMIFS, MROUND, MOD, VLOOKUP & More

Add to list

#Business

#Business Software

#Microsoft Office 365

#Microsoft Excel

#Accounting

#Payroll Accounting

#Human Resources

#Payroll Management

#Data Science

#Data Analysis

#Spreadsheets

#VLOOKUP Function

#Business Math