Description:

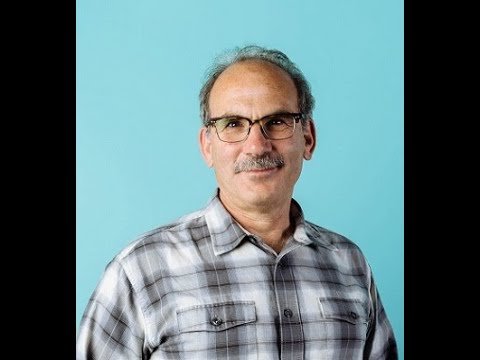

Explore deep learning applications in quantitative finance through this comprehensive ACM conference talk. Gain insights into the quantitative investment process, from raw data input to trade execution, and learn how deep learning sequence methods can be applied to various steps in this pipeline. Discover the fundamentals of feature extraction, return forecasting, portfolio allocation, and trading execution. Delve into sequence modeling, recurrent neural networks, and reinforcement learning in the context of financial decision-making. Examine technical features, qualitative factors, and the challenges of missing data in financial modeling. Discuss the future of reinforcement learning, explainability in deep learning models, and the distinction between deep learning and deep understanding in quantitative finance. No prior knowledge of finance or deep learning is required for this informative session led by David Kriegman, a distinguished computer science professor and industry expert.

Deep Learning for Sequences in Quantitative Finance

Add to list

#Business

#Finance

#Quantitative Finance

#Computer Science

#Deep Learning

#Machine Learning

#Reinforcement Learning

#Feature Extraction

#Sequence Modeling