Description:

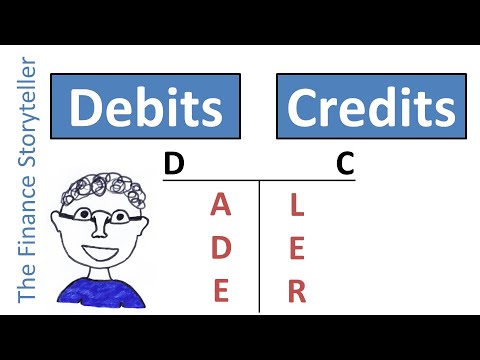

Learn the fundamentals of accounting in this comprehensive 3-hour 30-minute video series. Explore key concepts such as debits and credits, the accounting equation, double-entry accounting, and the relationship between balance sheets and income statements. Dive into topics like accruals, prepaid expenses, suspense accounts, and depreciation. Gain insights into the history of accounting, general ledgers, and the differences between US GAAP and IFRS. Master essential accounting tools including trial balances, T accounts, and closing entries. Understand crucial financial concepts like current assets and liabilities, Cost of Goods Sold (COGS), gross profit, and inventory valuation methods. This series provides a solid foundation for beginners and a valuable refresher for those looking to reinforce their accounting knowledge.

Accounting 101

Add to list

#Business

#Accounting

#Balance Sheets

#Financial Accounting

#Financial Statements

#Income Statements

#Double-Entry Accounting

#General Ledger

0:00 / 0:00